author

Regional Growth Director Europe

published-on

28 Apr 2021

tags

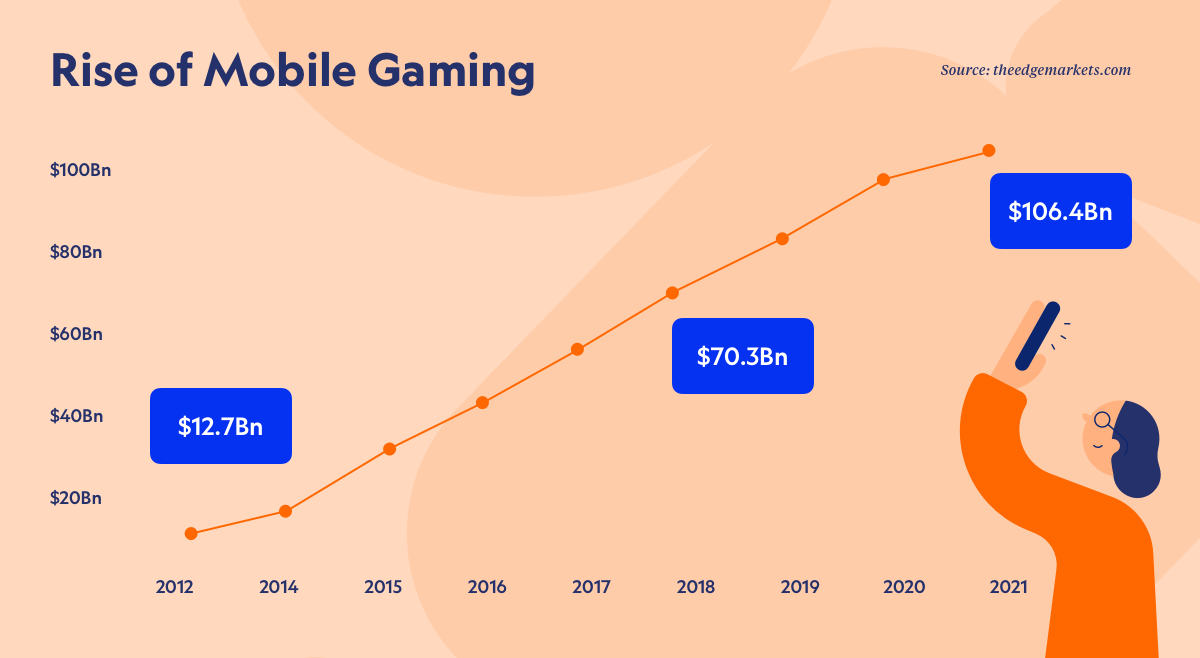

Mobile games industry has gone a long way from value added services to the giant it is today. Barely touching the 12-billion-dollar mark in 2012, in 2021, mobile gaming is projected to hit 100 billion in revenue[1]. The size of the gaming market means that it is now game on for telecom operators. Missing to rethink partnership with the gaming industry means wasting the chance to use this rapidly growing market for diversifying their business.

With their flat-rate performance in the last ten years, PC and console games are still 20+ billion industries[2] and far from insignificant. But mobile gaming has grown tremendously and now accounts for a whopping 74 per cent of total consumer spend on mobile apps[3]. It went from an industry trailing behind the term VAS services to a huge game-changer in consumer behaviour and revenue generation.

At the same time, Telecom operators’ core revenue streams are flagging: the markets are saturated, the prices for the core services stagnating with the introduction of flat rates, and the relationship with their user base growing colder.

With this situation being the case, isn’t it time for the telcos to reconsider their business model with game content providers?

Turning the (VAS) tables: Mobile gaming is not ringtones and screensavers

With the mobile gaming market booming, the entire ecosystem has changed. “Everyone participating in the ecosystem is invited to turn the tables and look at the ecosystem from a different standpoint,” says Centili Group CEO Zoran Vasiljev. Is it possible to turn away from the value added service paradigm, and shift the conversation about potential partnerships between mobile network operators and gaming providers? Can we talk about the value maximisation achieved through collaboration?

Revenue share vs revenue maximisation: potential for the lucrative future?

Revenue share vs revenue maximisation: potential for the lucrative future?

The shift from value added services to digital services

The term VAS has been obsolete ever since the rise of internet data. The mobile operators have moved on from offering their user base ringtones and screensavers to more substantial content. Back when coverage, phone minutes, and roaming were still a thing, telcos have compartmentalised the “additional services” under the term VAS, or non core services, without much reconsideration about the business models to this day. With the rise of internet usage and the advancement of mobile phone technology, the ecosystem has changed dramatically. Although some MNOs still stick to this terminology and the VAS-type of thinking, most of them are knee-deep in shifting from content service providers to digital service providers.

Much of the CSP to DSP transition relies on fine-tuning to customer usage preferences. Gaming happens to be the most lucrative way of monetising end-user behaviour, far gone from mobile VAS service.

Being in business for 70 years, telecom operators can find this hard to admit. But the fact is – 15, and even 5-year-old gaming companies today have bigger valuations than an entire sector in a single country. It is a serious and mature industry, with an additional boost of fresh users in response to the COVID-19 pandemic.

And not just that. In combination with esports, the odds are that it will explode with numbers becoming even more substantial.

The business model of the online gaming industry allows telecom operators to explore game advertising in richer and more innovative ways than what is possible in the download model. Continuous connectivity during gameplay also unfolds opportunities to extend the existing mobile gaming monetization models such as real-money transactions into the mobile realm.

Breaking free from revenue share, moving into revenue maximisation

Today, there are around one million mobile games on app stores. They account for around 20 per cent of all apps and a stable 10 per cent of time spent on all apps. [4]

These numbers were way different in the past, and MNOs felt they had an advantage in partnership conversations. So, the gaming industry was always pulled into revenue share conversations as a value added service. That is hardly surprising – those conversations followed the old way of thinking. It was convenient, and at the time, both telcos and gaming publishers considered that they shared the risk.

The revenue share was rarely in favour of the game publisher or the game developer, although they had done most of the legwork. Gaming companies needed telcos for the exposure and reach, which justified accepting the lower payout rates. Nowadays, the roles have changed: the telcos are the ones that should offer better deals to the gaming companies. Considering how gaming content is attractive to the younger core segments, it is imperative to do everything to keep them in the offer.

The alternative payment methods offer a better deal to game publishers

With the rise of the App Store, Google Play store, and different payment methods offering to take no revenue cuts, it is no wonder that the direct carrier billing model that the telcos offer to game publishers is getting out of favour. The result: fewer game producers are ready to promote DCB as a payment method, waiting for a better deal from the telcos.

The time has arrived for this topic to move into revenue maximisation. Because without game developers and publishers, there is no revenue to share.

Mobile gaming is estimated to reach $106.4 Bn in value by 2022.

Mobile gaming is estimated to reach $106.4 Bn in value by 2022.

It makes more sense to discover and work on maximising the sources of revenues available in the synergy between telco operators and gaming publishers, using the channels that mobile operators and e-marketplaces can provide instead of VAS services.

“The revenue-share thought process is about how much is enough. It is about understanding someone else’s cost structure to fit in. That is old school. Instead of being stuck there, it is more valuable to try and understand each other’s industries and current digital transformation in the gaming industry,” says Vasiljev.

That means finding a way to maximise the total revenue and not necessarily just always share.

A perspective like that is possible when the focus is getting the most out of that user with an extra dollar to spend. A great example is O2 in the Czech Republic that has provided War Thunder players with an easy way to buy game credits and get more value for their money. As one of the telco operators that moved swiftly into digital transformation mode, and away from observing gaming as a value-added service, O2 has realised that investing in a gaming brand has long-term potential and an incredible appeal to their younger end-user demographic. The synergy in marketing efforts has shown fruitful: War Thunder offered their customers a bonus in in-game currency if they paid via O2, and the O2 invested promotional efforts to let more of the users know about the deal, making the entire operation a success.

The distribution costs: is it time to reconsider the old game?

What keeps most gaming publishers from pushing the DCB as an equal payment method is the notoriously high revenue share per transaction. Beginning with the addition of value added services, the telcos haven't significantly moved the revenue share percentages in the past 15 years. Meanwhile, other payment gateways have made their way – credit cards, Paypal, and even cryptocurrencies now offer higher payouts, up to 100 per cent.

In a landscape like that, gaming companies design their payment journey to incentivise the users to choose other, more favourable payment methods. As a result, telcos are losing the opportunity to increase the payment traffic through facilitated DCB channels and miss on creating the tighter relationship and audience insights.

The common reason for keeping the payout to gaming companies lower than other payment methods is the cost of distribution. With brick-and-mortar top-up points and vast infrastructure that spends the resources on rents and labour, it is no wonder the distribution costs are high.

Another reason for high business costs is the digital services push marketing. With modern gaming brands, young consumers are so devoted that there is no need for it. On the contrary, partnering with such brands becomes an added value for telcos’ core services. Gaming brands contribute to MNOs’ brand relevance, their bundles gain more traction, and the push marketing becomes pull marketing.

Younger demographics call for agile digitalisation

However, telcos who are focused on the younger demographics already reconsider the old-school convenience and push the digital-based top-ups. The younger users have already accustomed to "digital-first" and consider the physical top-up points in kiosks and stores relics from the past.

Even more relevant for the cost distribution and maximisation is the telcos’ ability to enrich their digital bundle distribution. MNOs can follow their users in real-time, and place relevant, contextual offers by using the data. Telcos should have advanced systems for data collection and analytics to lead the conversation and offer their users what they need.

For example, when a user plays a game and the internet suddenly cuts off, it is a perfect moment for a contextual message to remind them to top up, even offering additional GB of data assigned to specific gaming content. Finally, suppose the operator enables that the user performs the transaction online (through a third-party site). In that case, it is the full spectrum of digital distribution of bundles, which carries incredible revenue maximisation potential and increases user satisfaction.

Digital transformation encompasses a multi-layered approach to breaking the old ways of business. It calls for a bold turn to younger demographics, considering the full spectrum of their user preferences, including the preferred content, service design, customer journey, and much more.

Optimising business costs are one side of the coin, while the other side is to prioritise the most promising partnerships. As long as telcos treat gaming as a VAS service and not as a business partner with multiple growth implications, plenty of untapped potentials will remain idle.

The mobile gaming industry keeps on growing; how can telcos keep up?

Mobile gaming is on a firm course of expanding, and with that, we can expect far more advanced games that will require better connection, faster download speed and data use. Companies like Centili enable the most advanced-minded telcos to access digital content and tap into its transformative power. Centili Maestro is a cloud-based platform for frictionless ecosystem orchestration, monetisation, and management. With this type of service, telcos can enter the entertainment market more decisively, latching onto the existing broad portfolio of gaming brands that are integrated with the platform.

E-sports and gaming are set to break records in the following years. Major sports brands like Formula 1 are already turning to e-sports and virtual races as equivalently important content for their younger audiences. Since the core of the esports audience are gamers, it is a natural progression of steps to grow one audience to reach the other faster.

By partnering with esports content producers and gaming publishers, long-sighted telcos will ensure their position with the younger audiences and maximise their digital portfolio revenue potential. And with that, they will push the notion of value added services into oblivion.

[1] Global mobile gaming industry set to generate US$120b in 2021 https://www.theedgemarkets.com/article/global-mobile-gaming-industry-set-generate-us120b-2021

[2] Videogames are a bigger industry than movies and North American sports combined, thanks to the pandemic https://www.marketwatch.com/story/videogames-are-a-bigger-industry-than-sports-and-movies-combined-thanks-to-the-pandemic-11608654990

[3] Mobile gaming is big business, accounted for 33 per cent of app installs and 74 per cent of spending in 2018 https://www.techspot.com/news/80473-mobile-gaming-big-business-accounted-33-percent-app.html

[4] App Annie: State of Mobile Games: Robust Growth in 2019 & Beyond, https://www.appannie.com/en/insights/mobile-gaming/the-state-of-mobile-games-in-2019-and-beyond/